Why Buy Now, Pay Later services like Splitit are focusing on physical retail

As e-commerce spending plateaus, payment providers with Buy Now, Pay Later (BNPL) services are continuing to tap physical retail as a means to drive business.

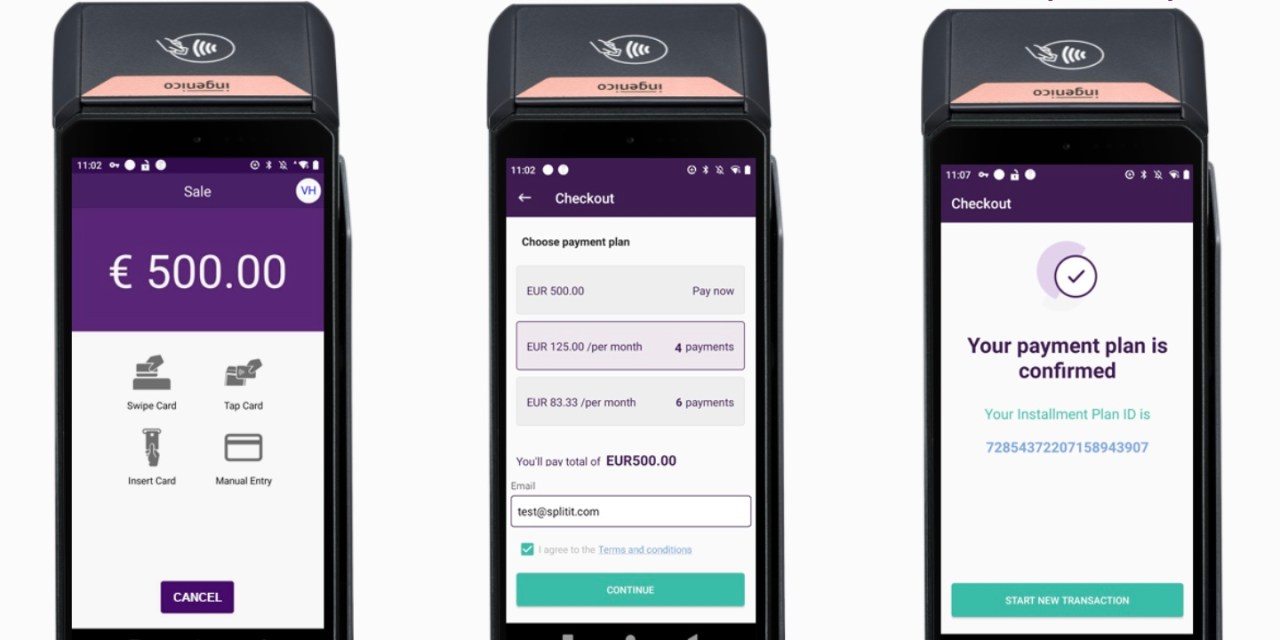

Splitit, a white-label BNPL provider, this month launched a partnership with point-of-sale terminal Ingenico that will allow retailers to offer payment plans at checkout without the customer having to sign up for any third-party payment provider.

Ingenico currently has about 40 million POS terminals globally across 300,000 merchants, and the new service will be added via a cloud-based system.

“Many of our merchants want to offer an omnichannel experience for their installment services,” said Nandan Sheth, Splitit CEO. “Unlike the more legacy traditional BNPL cells where there is a new loan originated and we have to go through a seven-step registration and underwriting process… our experience is zero friction, fully embedded.”

While BNPL is projected to make up roughly 5% of all global e-commerce transactions by 2025, per Wordplay, it’s less evolved in physical retail, which accounts for roughly 85% of all retail transactions. In turn, BNPL providers have been aiming to find new ways to marry the markets: in mid-2022, for example, both Affirm and Klarna released debit cards that allow payments to be split up with no interest. Meanwhile, Square-owned Afterpay’s app allows customers to use BNPL at participating retailers, and it’s also a built-in option at Square POS terminals.

Sheth said in-person demand for BNPL in-store is likely to succeed in high-ticket categories such as furniture, luxury apparel and home improvement. These are high-consideration spaces where people want to see the item before they buy it, and where tickets routinely run between $500 and $5,000.

Sheth said that he thinks Splitit’s white-label technology on the Ingenico platform will provide an edge over the major player competitors because customers won’t have to sign up or think about another account to create.

Ad position: web_incontent_pos1

The user also doesn’t pay a fee or any interest to Splitit, which earns revenue by charging the merchant using a subscription-based service. And from the retailer side, it’s up to them whether they want to incorporate the Splitit options into their POS.

Sheth didn’t have any data to share about participation yet, as the program was announced Feb. 1 and is still rolling out.

“If you think about the size of the market, and the merchants’ need to have a frictionless experience, the demand is massive,” he said.

Usage patterns and risks

Retailers and payment processors are increasingly focusing on offline sales in part because of how many transactions still happen in stores. Affirm CEO Max Levchin said in a letter to shareholders last week that the company’s Debit+ card is a “high conviction bet.”

The card is linked to a customer’s bank account, so they can opt to pay for a purchase in full or split it up over time — allowing the flexibility of a credit card payment without any associated interest. Specific data on the amount of Debit+ users or transactions wasn’t available, but it has roughly tens of thousands of consumers, and Levchin said the company is working to “fine-tune its unit economics.”

For retailers, integrating BNPL in person may look like adding it to the POS terminal via a third party. Fast-fashion retailer Forever 21, for example, allows in-person shoppers to opt for Klarna or Afterpay. Chief Marketing and Omni Channel Officer Jacob Hawkins told Modern Retail that while the privately-held brand couldn’t share breakdowns of payment methods, offering BNPL in store has been a successful implementation.

Ad position: web_incontent_pos2

He said it serves customers who don’t have a credit card but want that same experience of leaving a store with an item without paying for it that day. A PayPal-commissioned survey in April 2021 found that 79% of millennial and Gen Z BNPL users were more likely to make repeat purchases at a merchant that offered the service.

“For some customers, it’s just a different form of [credit], whether it’s Klarna or Afterpay,” he said.

Michael Hershfield, founder and CEO of Accrue Savings that offers a “Save Now, Buy Later” option for installment plans, said that while BNPL gives customers a flexible option, it also opens the door to debt. Fitch Ratings in July 2022 found delinquencies among major BNPL providers had more than doubled over several quarters.

“The idea of installment payments is one where consumers are there. They want it, and I think we’ll have continued adoption. But this comes with risk, and we’re seeing that with the rise of delinquencies in the category,” Hershfield said.

Still, Sheth from Splitit is bullish on the new POS terminals as a means to provide payment flexibility without delinquency risk.

Splitit doesn’t underwrite any loans for purchases as some other BNPL operators do. Rather, it uses existing credit that the shopper has and charges them in installments. Utilizing existing credit, he said, means the shopper doesn’t have to take on an additional loan or payment.

“If you look at the traditional BNPLs, they’ve really not even scratched the surface point of sale, because their experiences are multi-step, requiring an underwriting of a loan,” Sheth said. “We don’t have any of that. If we execute on this relationship, we could very easily become the market leader for point of sale installments with this partnership.”