Why legacy retailers like Michaels and Nordstrom Rack are undergoing major rebrands

Legacy retailers are giving their brand image a makeover.

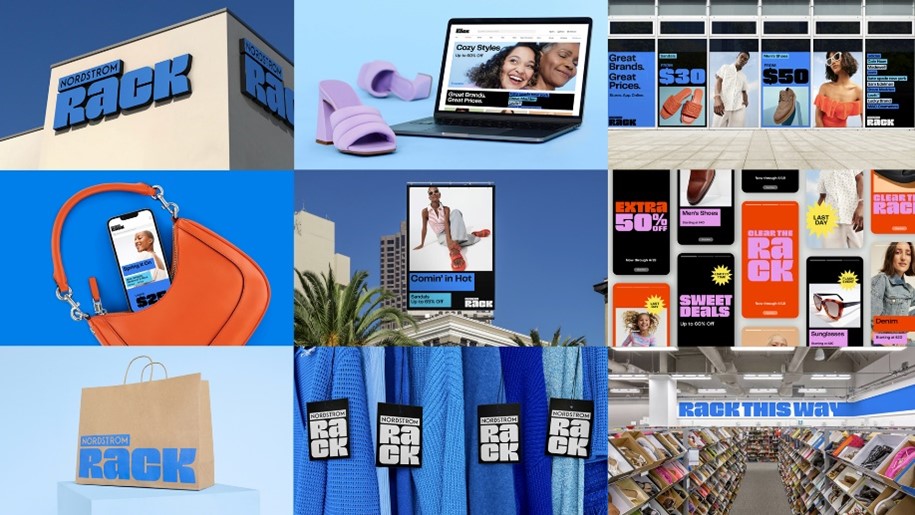

Arts and crafts retailer Michaels announced earlier this month that it is launching a “refreshed brand identity,” that positions itself as a key part of bringing customers’ creative ideas to life. Nordstrom Rack said that it plans to roll out a new logo, which took inspiration from the 1970s and 80s Rack logo. After changing its name from Ashley HomeStore to Ashley, the furniture retailer is continuing its rebrand by remodeling its stores and updating its style this year.

Shoppers preferences and expectations have drastically changed in recent years, experts said. While having a brand refresh is a natural part of retailers’ life cycle, this wave of rebranding is much more comprehensive. Legacy retailers with massive store fleets and sales channels rooted in the ’80s and ’90s are not only changing their brand logos but also their target audience, store formats and assortment in an attempt to reinvigorate the brand for digitally savvy shoppers.

“This new wave of rebrands is all-encompassing,” said Amanda Astrologo, partner at consultancy firm the Parker Avery Group. “When you rebrand now, it’s web, it’s store experience, it’s your marketing message. It’s totally cross-collaborative.”

These retailers are approaching their rebrands from multiple angles. For example, Michaels unveiled a new tagline “Everything to Create Anything,” but it has also updated its store signage, online experience, logo and marketing. In addition to its name change Ashley, it is reorganizing its stores to emphasize new products and also unveiled new lower price points. Michaels was founded in 1973 and has 1,290 stores, while Ashley’s history can be traced back to 1945 and operates 1,100 locations worldwide.

Ad position: web_incontent_pos1

Many of these rebrands, though, are focused on adjusting their image to appeal to a new generation of customers. “It’s always about refreshing and continuing to re-communicate to build your brand,” said Rachel Dalton, head of retail insights at Kantar. “It’s particularly important today because of the competitive environment.”

Nordstrom Rack said that this rebrand is meant to differentiate the brand from its competitors as well as “attract new customers and better connect with existing customers.” The updated logo is also meant to reflect Nordstrom and Nordstrom Rack’s intertwined business model. A major backdrop of this brand refresh: Nordstrom Rack sales declined 4.1% in the second quarter.

“Through this new comprehensive and cohesive brand identity system, we aim to evolve our brand expression so we can effectively communicate our brand proposition, great brands at great prices, and invite customers to Rack their way,” Red Godfrey, vice president of creative at Nordstrom Inc., said in a press release.

Ad position: web_incontent_pos2

Ashley, on the other hand, previously told Modern Retail that it wants to boost its brand consideration among younger consumers. “One of the things that we found is that our consideration was a bit behind our awareness,” Kelly Davis, vp of marketing strategy at Ashley, previously said.

Kantar’s Dalton said that these rebrands are especially more crucial now due to the slowdown in consumer spending. “Retailers really want to continue to make their current customers happy and glad to come into their stores,” she said. “I think it’s more of a necessity than it is than it is not.”

Rebranding in today’s retailing environment is by no means easy. Barry Thomas, senior thought leader at Kantar, said retailers are having to consider a longer list of variables. He said retailers will have to consider convenience, localization, experiential, social and sustainability. “I don’t think they were doing that in the 80s,” said Barry Thomas. “You just have more variables, more areas you have to dial up for this more demanding connected consumer.”

But if done well, these rebrands can yield strong returns. For example, after a hedge fund bought out Barnes & Noble in 2019, it started to transform its brand, taking inspiration from neighborhood bookstores. Local stores were given more authority to order what shoppers in the area wanted to see and read. The company also embraced social media content creators and trends on TikTok. After years of closing stores, Barnes & Noble is now aiming to open 30 new locations in 2023.

“The minute that you see a retailer investing in their store experience or really going all in, it gives them viability,” said Parker Avery Group’s Astrologo. “It makes the consumer have a little bit more confidence that they’re going to be around.”