How Stitch Fix uses data to guide plus-size styles for brands like Chloe Kristyn

Stitch Fix is adding to its plus-size offerings by working with smaller brands like Chloe Kristyn on exclusive lines that draw on its vast network of customer data points.

Stitch Fix, a personal shopping and styling service founded in 2011, first launched plus items in 2017. Back then, it offered 75 brands, Madison Young, head of the women’s plus division at Stitch Fix, told Modern Retail. Today, that number has doubled to 150 and includes apparel from The North Face, Calvin Klein and Vince Camuto. Stitch Fix has also collaborated with brands including Rebecca Minkoff, Michael Stars and Karl Lagerfield Paris on their first-ever plus-size collections and is working to make its exclusive brands 100% size-inclusive by 2025.

“It’s a business that we do see continued progress and growth potential behind,” Young said. “Almost 70% of U.S. women are a size 14 or above, but as you look at the apparel offering and marketplace, that offering within plus is less than 20%… Plus is definitely an area that we feel very passionate about to continue to stand behind and evolve at Stitch Fix, but also within the total market.”

Bettina Benson, Chloe Kristyn’s founder and creative director, began working with Stitch Fix on a plus collection after receiving a 2021 grant from its Elevate program, which was created to support the next generation of entrepreneurs of color and promote more diversity in retail. It took six months to develop the collection, Benson said. To help with the process, Stitch Fix gave Benson access to its plus-size toolkit. “The toolkit is really focused on fit and development,” Benson told Modern Retail. “I really think it helps brands approach this to design for a real woman’s body.”

Data is at the heart of Stitch Fix’s approach to apparel. Its internal tech design team regularly looks at how items are performing and does a “deep dive” on products at least twice a year. It also relies on customers’ feedback in five areas: size, price, quality, style and fit. More than 85% of customers voluntarily leave comments at checkout when they are purchasing or returning an item, Stitch Fix says. It then shares this information about what works and what doesn’t with brands so they can improve offerings going forward. Stitch Fix has amassed 75 million data points from its customers buying plus-size clothing.

Stitch Fix launched its plus-size toolkit last fall and has received positive feedback from brands, according to Young. Coupled with access to customer data, “it’s been a really helpful starting-off point,” she said, especially for brands who have not offered plus-size clothing before. “It gives guidance and a little bit more education, because to scale into plus, you want to do so really thoughtfully and intentionally,” she said. All vendors have access to Stitch Fix’s fit tools, which are free to use. Stitch Fix offers price parity for its plus and core assortments, Young said. “I think that also empowers our buyers and our merchants at the time of sourcing and negotiating, because we do offer that inclusive and kind of equal experience.”

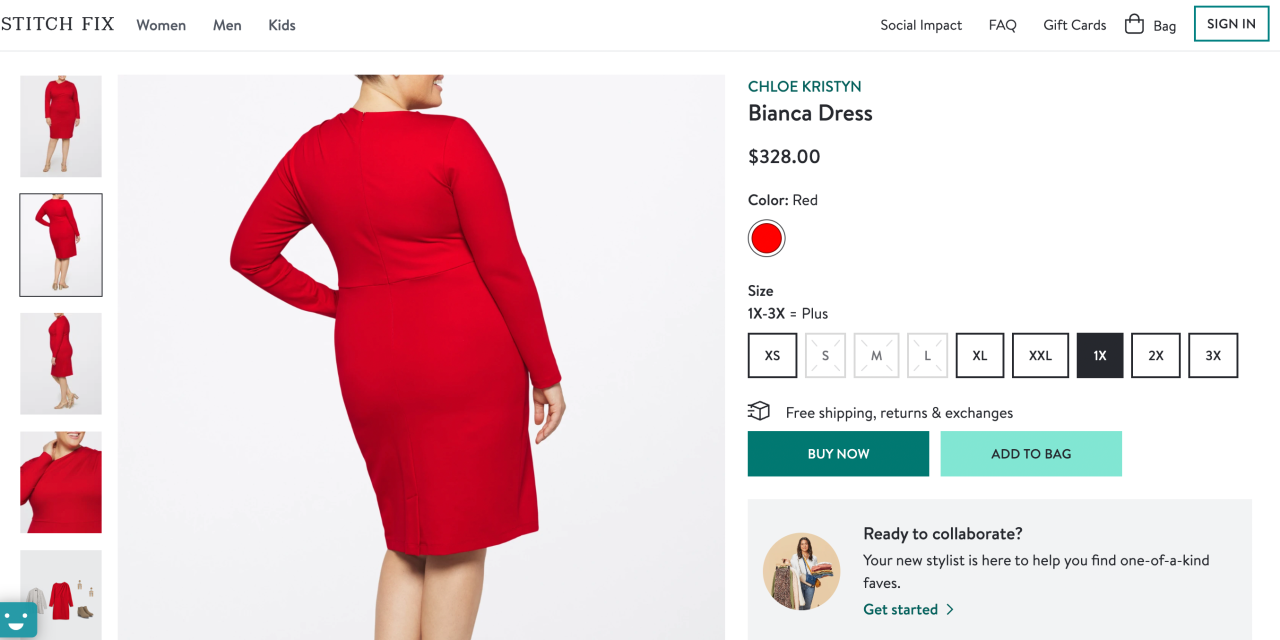

Chloe Kristyn’s plus-size line, available now, includes nine women’s items ranging from a cut-out knit bodysuit and sweater to a wide leg pant and tie waist blouse. The items retail for $198 to $498 and come in colors such as black, red, green and brown.

Ad position: web_incontent_pos1

Benson looked at the top performers in Chloe Kristyn’s core collection when developing the plus collection. For example, Chloe Kristyn’s items made with a ponte fabrication — a thick, double-knit fabric design — are bestsellers. “We basically used the data that indicated what the top performers were in core, and then took those styles and developed our plus collection,” she told Modern Retail.

Benson launched Chloe Kristyn six years ago, in 2016. Her background was in medical sales, she told Modern Retail, and she never envisioned “climbing the corporate ladder,” but after having her daughter, she pivoted to fashion. “I could not find what I was looking for on the market to support my busy lifestyle, at a price point that I felt was an accessible luxury price point,” she said. Benson named the brand after her daughter Chloe and their shared middle name Kristyn.

From the get-go, Benson was interested in selling both plus-size and core-size items. “When I started the line, plus was an underserved market, particularly in the higher-quality, more luxe categories,” she said. “I was intrigued by that, because… my personal philosophy is one of inclusion, as I am a Black woman. So I’m very conscious of that.”

Even before partnering with Stitch Fix, “I had a strong desire to want to expand into that category,” Benson continued. “But I knew that this woman also needed to be able to trust me. And trust that we were offering her a garment that had the same amount of attention to detail and care put into the development process as a core-size garment.”

In the fashion industry, plus-size clothing refers to sizes 1X to 6X and extended sizes such as 7X and above. In the U.S., sales revenue for women’s plus-size apparel grew 18% in 2021 compared to 2019 — over three times faster than overall consumer spending on the women’s market — according to The NPD Group. The global plus-size apparel market is on track to reach $696.7 billion by 2027, Allied Market Research found.

Ad position: web_incontent_pos2

“Inclusive sizing continues to be an opportunity for brands in the apparel space, especially when it comes to activewear,” Kristen Classi-Zummo, apparel industry analyst at the NPD Group, said via email. “For the first half of ’22, plus-size active apparel grew double-digits compared to last year, while missy sizes [usually 0-16] declined. This consumer is proving that she is looking to refresh her wardrobe, and she is supporting the brands and retailers who have the right assortment for her at the right price.”

Stitch Fix hopes its data and toolkit can help grow that market. For the brands it works with, “they know that as they look to continue to expand upon future plus assortments, they have a really strong grounding in place to be able to make future decisions,” Young said.