DoorDash adds Sephora in push to diversify quick-delivery offerings

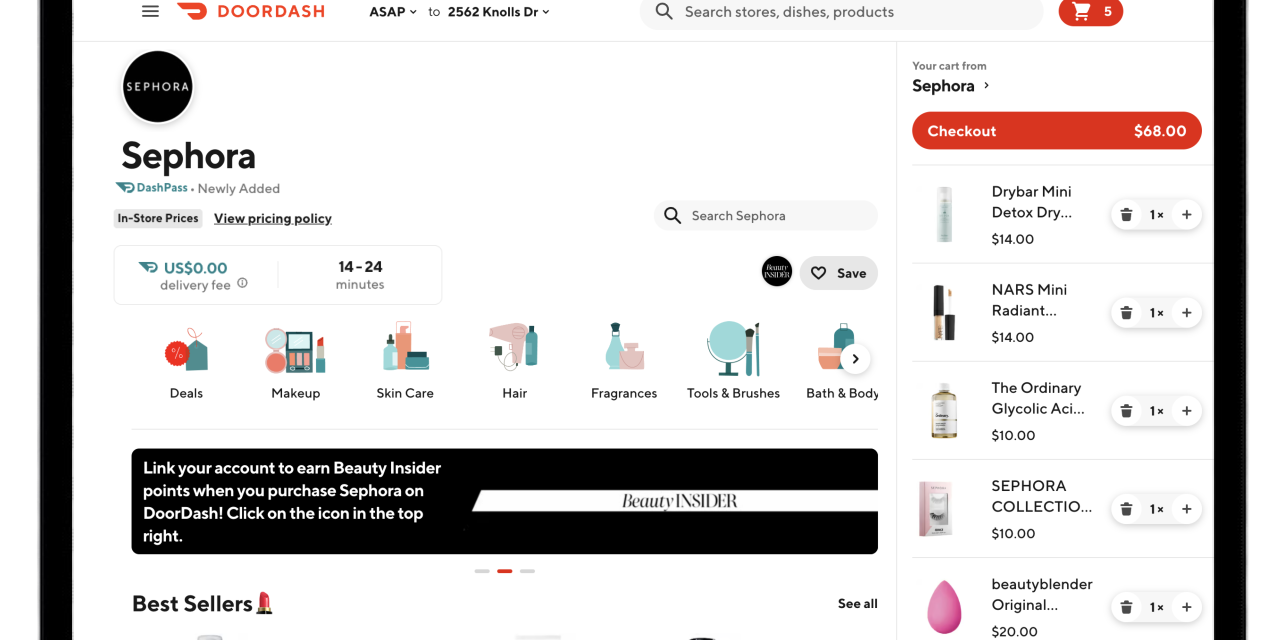

DoorDash is adding Sephora to its marketplace offerings, marking the delivery service’s first foray in high-end beauty amid an overall expansion into new product categories.

The partnership, announced Wednesday, means DoorDash customers can shop from Sephora directly through the app and receive products from a nearby store within an hour. DoorDash is also launching a new “Beauty” category to highlight the incorporation.

It’s part of an overall push by DoorDash to grow beyond its restaurant-focused beginnings. In late October, DoorDash added Tractor Supply to its app, its entrance into the farm category. And in September, it added Dick’s Sporting Goods as its first sports partner.

“We see this trend of convenience being pulled forward through all the various verticals, and we see demand for the beauty category,” said Shanna Prevé, DoorDash’s vp of partnerships,

The expansion comes as competitor Instacart, which built its brand on grocery delivery, also expands into non-food categories like furniture and appliances. And overall, consumers are showing increased interest in fast delivery: research firm Technavio found in October that same-day delivery market share is expected to grow at a CAGR of 21.4% through 2026, bolstered by the ubiquity and convenience of smartphones.

Prevé said she anticipates Sephora orders might come from people who are looking to quickly restock after they run out of an item, those who are traveling, or people who want to send a unique gift.

“It was always part of the plan,” she said of the expansion. “We want to make any shoppable item in your local community available at your doorstep in minutes. Not hours, not two days from now.”

New categories

The company began diversifying its offerings beyond restaurants about four years ago, Prevé said. That included a move into grocery in August 2020, plus speciality retail like as Office Depot this March and Bed, Bath and Beyond last fall.

Ad position: web_incontent_pos1

As of December 2021, about 14% of DoorDash’s 25 million customers shopped the newly added, non-restaurant categories.

“New verticals are growing faster than even our core business,” she said. “So we’re investing a lot there, and we’re seeing great results with our consumers.”

Amit Kalley, CEO at e-commerce platform Infosys Equinox, said that consumers are expecting speedy and efficient delivery especially since the pandemic. The online shopping boom left many customers comfortable with getting items delivered day-of, or at least within two days.

“There’s been a fundamental shift in consumer behavior toward digital,” he said. “What that ends up meaning is consumers aren’t just expecting but demanding they get the same experience, same convenience, same level of service, they’re used to as when they’re in store.”

For DoorDash, that means an opportunity to pull in new customers. At its third-quarter earnings call last week, CFO Prabir Adarkar said DoorDash is expanding into new categories because they add scale to the business. In particular, they attract new customers who don’t currently use DoorDash for restaurants.

Ad position: web_incontent_pos2

“They can now use it to get the flowers or get their convenience items or get their grocery items or get their liquor delivery,” he said. “And so a growing number of our new customers now are actually coming to DoorDash to try these new categories, and this is going to unlock the next leg of growth as we continue increasing our penetration of the U.S. population.”

DoorDash is also pushing DashPass, its $9.99 a month membership plan that waives delivery fees and provides special offers like coupons and credits.

Jan Soerenson, North American general manager for commerce experience platform Nosto, told Modern Retail that apps like DoorDash may be diversifying more now ahead of a potential recession. This will help them match supply to demand, especially if consumers shy away from costly restaurant orders.

“Given a possible looming recession, I believe many delivery apps today want to avoid the situation Uber faced post-Covid when it had to ramp driver count back up quickly and wasn’t able to when demand returned,” Soerenson said. “Better to keep the supply side busy.”

The draw of Sephora

DoorDash soft launched Sephora shipments in mid-October. Prevé did not share order numbers but said early demand appears strong. Top sellers include cult favorites like The Ordinary’s glycolic acid, Beauty Blenders, Olaplex hair products and Charlotte Tilbury’s Pillow Talk lipstick.

For Sephora’s part, the move to DoorDash could mean more customer acquisition. On DoorDash marketplace, customers who search for any of the 340 beauty brands offered by Sephora can wind up placing an order.

“I think that’s one of the reasons why a lot of retail partners are excited to launch on DoorDash, is that they access fundamentally a different consumer set,” Prevé said.

A Sephora spokesperson declined to share how many same-day orders it currently receives, or what share of customers use same-day delivery services. But the retailer has been adding an increasing number of options. In September 2020, it partnered with Instacart, and in November 2021 it launched its own same-day delivery service. It was added to the Shipt marketplace in March 2022, and this fall announced a $49 annual subscription for unlimited same-day shipping.

Nadine Graham, svp and general manager of e-commerce for Sephora, said in a news release that the partnership with DoorDash is “a natural next step in the continued evolution of ease and convenience” for consumers.

Kalley from Infosys Equinox said that for retailers, partnering with apps like DoorDash can help solve issues around last-mile delivery, which might be expensive or cumbersome for larger retailers to map out across the country. And whether it’s with an app, internal logistics plans or a mix, he anticipates more retailers will find ways to figure out same-day shipping from retail locations as a way to address logistics cost pressures.

“Every retailer is in some space of adopting it,” he said.