Modern Retail Research: Brand and retailer holiday outlooks are tinged with economic anxiety

Holiday shopping has pretty much come to close, and it was punctuated by growing insecurities.

With inflation rising and the threat of a recession on the horizon, many brands and retailers have been unsure how this fourth quarter would stack up compared to years past. And a recent Modern Retail and Glossy survey shed light on these fears.

According to a group of brand and retailer leaders we surveyed, one-quarter of respondents believed their holiday revenue would drop this year compared to last. While the majority (61%) thought the holiday revenue would increase, most in that camp (39% of all the respondents) believed seasonal sales would only go up “slightly.”

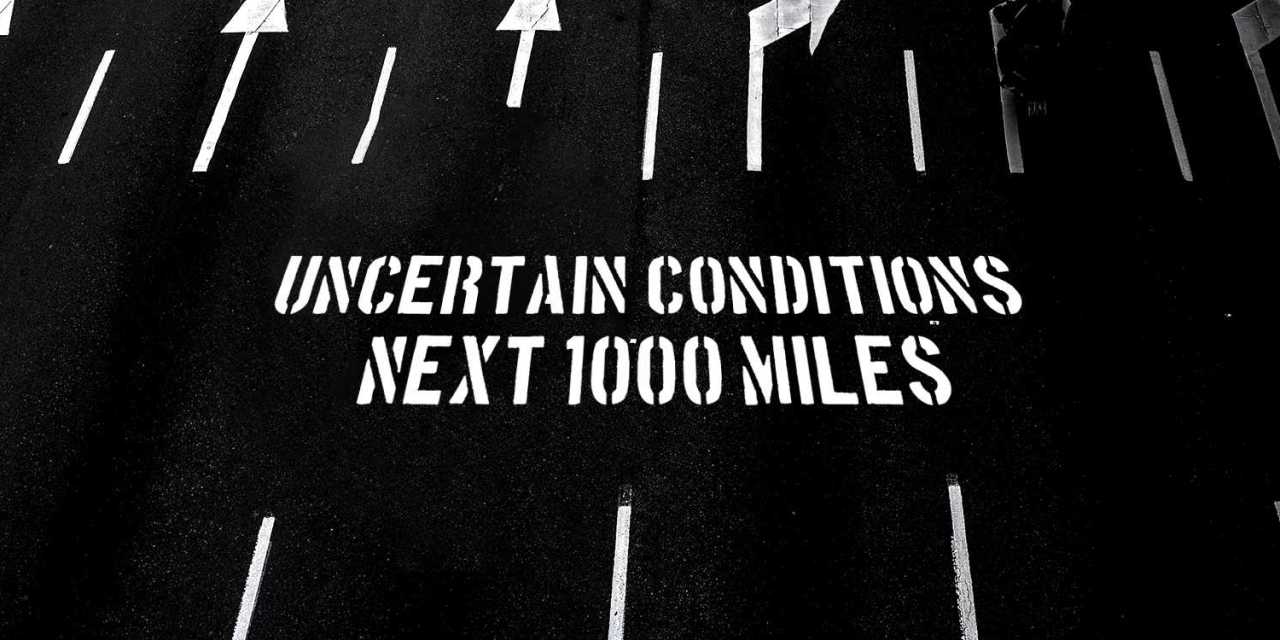

It’s a distinct shift from years past when most sales were going up amid a thriving U.S. economy. Now, myriad elements are giving retailers pause and making them rethink the playbooks of old.

One big change this year is the rising amount of inventory major retailers still have. Earlier this year, brands like Levi’s, American Eagle and Gap all had high levels of inventory, with levels up 43%, 36% and 37% respectively. Even major retailers are feeling the inventory heat; Target at its most recent earnings said it had $17.1 billion worth of excess inventory, up from $15 billion the year prior.

This has led many companies to increase discounts in an attempt to offload products. But some retailers have been wary about upping discounts, given rising prices. The Modern Retail and Glossy survey reflected this strategic uncertainty. One-quarter of respondents said they had somewhat steeper discounts last year compared to this year. Meanwhile, 22% said this year they were posting bigger discounts. And over half said the promotions were about the same.

Ad position: web_incontent_pos1

The results give a sense for the uncharted territory retailers and brands are facing. Consumer demand is unclear and a recession may be on the horizon, but many brands are still trying to figure out the way to keep business as profitable as possible. As such, business decisions — as shown in these results — are more conservative and tinged with anxiety for the future.