Research Briefing: As Target launches Circle 360, here’s how it stacks up against other membership programs

In this edition of the weekly briefing, we examine Target’s recent announcement of its revamped membership program as seen in data from Modern Retail+ Research.

Interested in sharing your perspectives on the future of retail, technology and marketing?

Apply to join the Modern Retail research panel.

Target’s new paid membership program competes against incumbents

Breaking News: Target recently announced its new Target Circle 360 membership, an improved paid version of its free Target Circle program. This week, it finally launched.

Previously Target’s program only included Target Circle which offered access to coupons and certain savings. With the new paid tier, the retailer offers free same-day delivery and 2-day shipping, among other fulfillment options. The new membership option is in direct competition with Walmart+ and Amazon Prime which both also focus on free fast shipping options. Other big box retailers have also launched revamped membership programs such as Best Buy, which used a tiered membership with different benefits at each level. Beyond big box stores, specialty retail stores have also historically had membership programs as well and have seen much success, like Sephora’s Beauty Insider program.

Questions: How does Target’s paid membership program compare to others? What are strategies that retailers can learn from the current competition?

Ad position: web_incontent_pos1

Answers From Research:

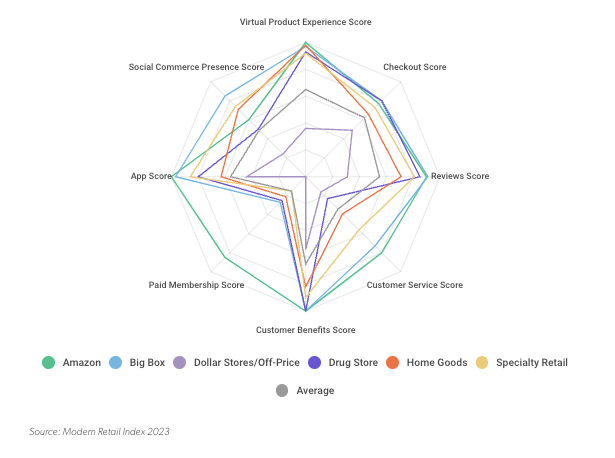

In Modern Retail’s annual E-commerce Index, Best Buy and Walmart were two members of the big box cohort that offered — and indeed bolstered — membership programs in 2023.

In June, Best Buy overhauled its membership program to introduce a new tiered model featuring an additional mid-priced tier, stating in August that it expected the My Best Buy Membership program to contribute at least 25 basis points of enterprise year-over-year operating income rate expansion — and that it was seeing growth in year-over-year paid membership sign-ups.

Walmart on the other hand has continued to expand its membership program’s benefits. In last year’s index, Modern Retail+ Research noted Walmart’s partnership with Paramount+ streaming services. This year, Walmart Plus added early access to promotional deals, including early access to Black Friday deals and an exclusive weekend of deals in July called Walmart Plus Weekend — a direct competitor to Amazon’s Prime Day.

Ad position: web_incontent_pos2

Another cohort with strong membership programs was specialty retail. While the cohort mostly offers non-paid memberships, the group places a large emphasis on creating loyalty programs with high incentives for the customer.

Sephora has one of the most famous loyalty programs in the index. Its “Beauty Insider” program features a tiered system based on annual customer spending amount, with benefits increasing as customers spend more in a year. Similarly, Ulta and Dick’s Sporting Goods also offer memberships based on a customer’s annual spend amount, with increasing benefits the higher the tier and the more the customer spends.

Other cohorts looking to create loyalty programs can look to the specialty retail group for examples of non-paid memberships that aim to increase annual spending rather than draw revenue from membership fees.

Want to learn more: Modern Retail+ Research’s Annual E-Commerce Index examines paid memberships and their relationship to online retailer strategies.

READ MORE ABOUT MEMBERSHIP PROGRAMS

See research from all Digiday Media Brands: