Research Briefing: What the delayed Kroger-Albertsons merger means for retail media

In this edition of the weekly briefing, we examine the U.S. Federal Trade Commission’s decision to block the Kroger-Albertsons merger and its effect on retail media as seen in data from Modern Retail+ Research.

Interested in sharing your perspectives on the future of retail, technology and marketing?

Apply to join the Modern Retail research panel.

FTC’s merger block could shift retail media expectations

Breaking News: The U.S. Federal Trade Commission is suing to block the merger of Kroger and Albertsons supermarkets. Henry Liu, director of the FTC’s Bureau of Competition, cited increasing grocery costs as a reason for the blockage.

“This supermarket mega merger comes as American consumers have seen the cost of groceries rise steadily over the past few years. Kroger’s acquisition of Albertsons would lead to additional grocery price hikes for everyday goods,” Liu said in an FTC press release. The merger would make Kroger-Albertsons the second largest grocer in the U.S., behind Walmart. The combined retailers would also create a retail media network that would rival some of the top players in the industry.

Questions: What is the current state of retail media? If the Kroger-Albertsons merger succeeds, what are the expectations for the combined retail media group?

Ad position: web_incontent_pos1

Answers From Research:

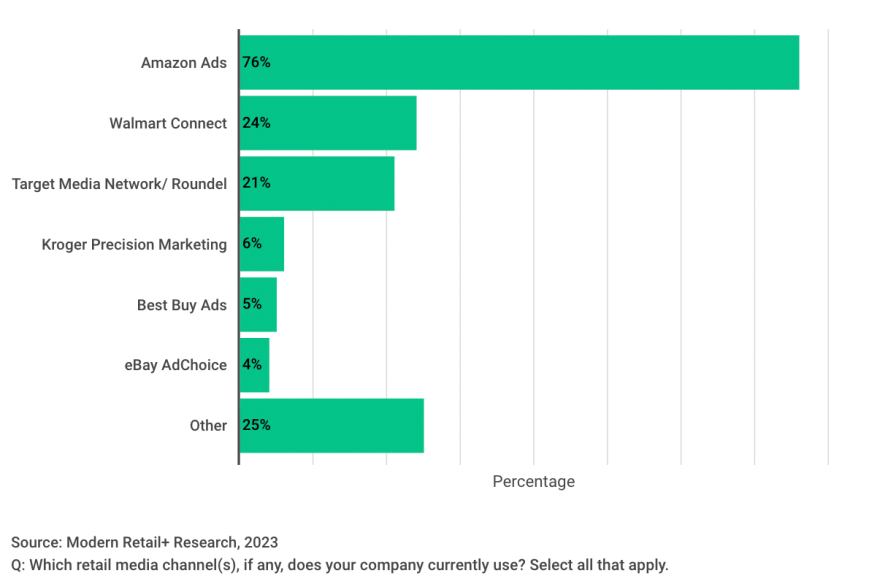

Kroger’s Kroger Precision Marketing was selected by 6% of survey respondents as a retail media network their company currently uses. However, through the company’s merger with supermarket giant Albertsons Companies (Albertsons has its own RMN, Albertsons Media Collective), the network may see an increase in adoption.

Kroger’s merger with Albertsons would, according to experts, bring an increased focus to retail media, and the combined entity may even be able to challenge Walmart Connect by presenting brands with a more compelling ad offering and a greater breadth of data to use in ad targeting. On its own, Kroger Precision Marketing reported a 13% rise in engagement from digital shoppers in Q1 2023. The combined entity will be able to reach approximately 85 million households, according to the two companies when they announced the merger.

Ahead of the possible merger, Kroger and Albertsons are two of several retail media network partners that recently collaborated with Omnicom Media Group to help it hammer out retail media-related data standards, as outlined in OMG’s Council on Accountability and Standards in Advertising retail subgroup.

Ad position: web_incontent_pos2

Want to learn more: Modern Retail+ Research’s analysis of retail media networks examines the direction that retail media networks are headed.

READ MORE ABOUT RETAIL MEDIA NETWORKS

See research from all Digiday Media Brands: