Research Briefing: Amazon expands grocery, while others falter

In this edition of the weekly briefing, we examine Amazon’s recent announcement of its expanding grocery delivery program and Outfox Hospitality’s bankruptcy as seen in data from Modern Retail+ Research.

Interested in sharing your perspectives on the future of retail, technology and marketing?

Apply to join the Modern Retail research panel.

Grocery remains difficult for smaller retailers

Breaking News: Foxtrot, an upscale convenience store and grocer, recently announced its plans to close its stores and business. This news comes five months after its merger with Dom’s Kitchen & Market, another upscale grocer. Among three former Outfox employees who spoke with Modern Retail, the sentiment was that Foxtrot was a company that was struggling to figure out what it wanted to be. It struggled to figure out the right balance between brick-and-mortar and e-commerce sales.

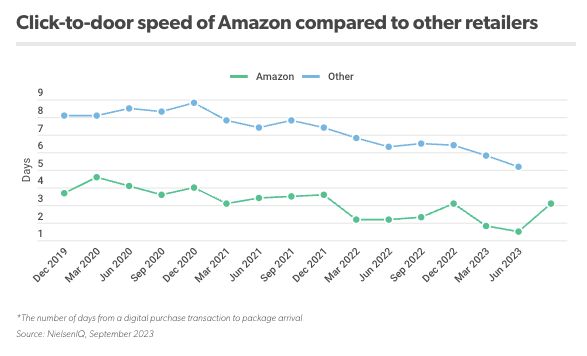

While newer grocers, like Foxtrot, struggled to find a foothold in the competition, Amazon announced its expansion of grocery delivery options. For $9.99 per month, Prime members are able to have unlimited grocery delivery from Whole Foods Market, Amazon Fresh, and other local grocers as well. The grocery retail space continues to be dominated by old-guard players, like Walmart and Target, and the main competitor now is Amazon with its delivery speed.

Questions: What sets Amazon grocery apart from other big box retailers with grocery options? What other fulfillment options are the big retailers using? Where are they also investing?

Ad position: web_incontent_pos1

Answers From Research:

In Modern Retail’s annual fulfillment index, Amazon ranks as the No. 1 retailer in the Modern Retail Index, a position it has held since the index debuted in 2021. Amazon has maintained its spot at the top of the index because it continues to innovate its fulfillment offerings. Since its genesis, Amazon has built a powerful supply chain network to support its massive e-commerce business.

Amazon also continues to find innovative ways to speed up delivery times via the skies. In 2019, Amazon broke ground on the Amazon Air Hub, an 800,000-square-foot facility to support its in-house air cargo network, located at the Cincinnati/Northern Kentucky International Airport. Since then, Amazon Air’s flight activity has significantly increased. A report by DePaul University found a 6% increase in flight activity between September 2022 and March 2023. Amazon Air now operates 205 flights per day, up from 85 three years ago. Additionally, in October 2023, Amazon announced that drone deliveries of medications were available for Amazon Pharmacy customers in College Station, Texas. The drone deliveries are free and shoppers can expect to receive medications in under 60 minutes.

Walmart and Target are also building up their fulfillment and delivery infrastructures in order to keep up with Amazon’s expansive same-day delivery network and membership programs. Part of their plans to cut down on last-mile delivery costs have included building more micro-fulfillment centers and large-format stores that act as fulfillment hubs for online orders, including drive-up and same-day local deliveries.

Ad position: web_incontent_pos2

To help with local deliveries, Target Corp. invested $100 million to build a larger network of supply chain hubs, dubbed “sortation centers,” near Target stores in order to sort, batch and route orders that store staffers pack. With more sortation centers close to stores, Target can deliver more packages the next day. By January 2026, Target plans to have built 15 of these facilities. Target executives believe the store-based fulfillment model boosts inventory and supply chain capacity, and the retailer can fulfill demand across any of its omnichannel offerings, whether that’s drive-up, in-store sales or online orders.

To keep up with Target and its competitors, Walmart similarly announced in 2022 that it would be building ‘next generation’ fulfillment centers slated to open by 2026. The fulfillment centers are intended to combine the manual labor of Walmart’s staffers with advanced technology and machine learning to increase shipping and delivery for Walmart.com orders. As of the first quarter of 2024, five next-gen fulfillment centers have been built. According to Walmart, these new facilities, combined with the rest of Walmart’s fulfillment network, will enable the retailer to reach 95% of the U.S. population with next- or two-day shipping.

Want to learn more: Modern Retail+ Research’s Annual Fulfillment Index examines retailer fulfillment strategies and where they are headed.

READ MORE ABOUT RETAILER FULFILLMENT STRATEGIES

See research from all Digiday Media Brands: