With shoppable Instagram Reels, live selling may get a new life

Despite years of failed attempts, live video shopping may finally become bigger in the United States.

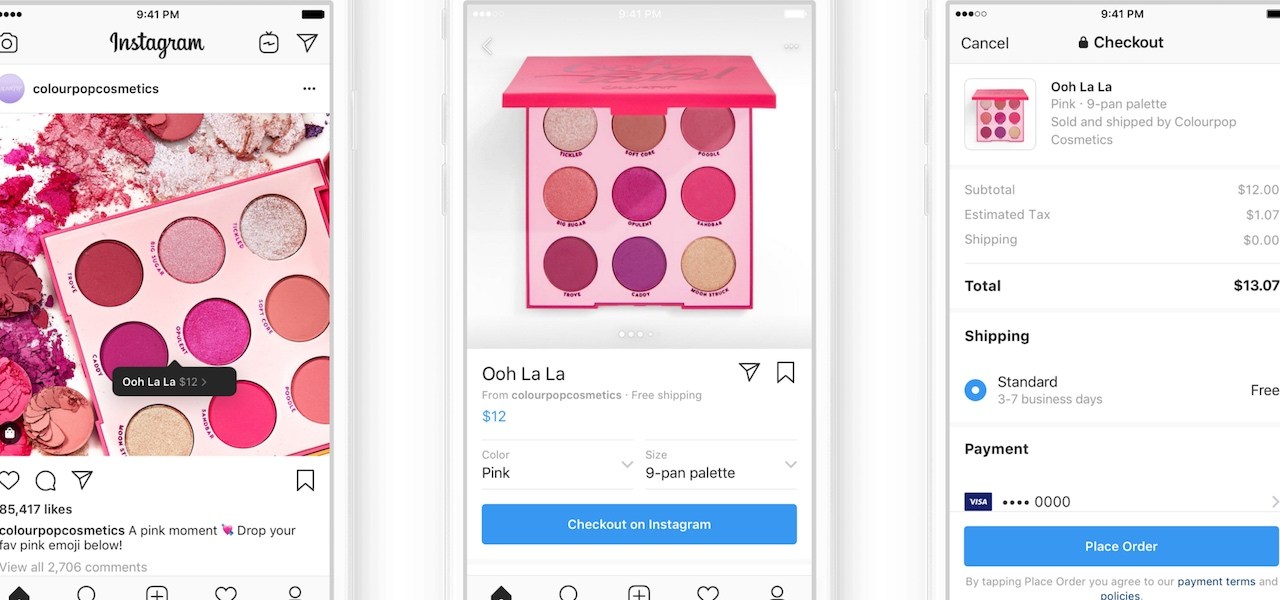

A number of large social platforms are bulking up their live-streaming capabilities and adding shoppable features. TikTok, for example, is beginning to test out an integrated “shop” button that brands can use in posts. Most recently, Instagram released a shoppable Reels feature allows viewers purchase within video content. The concept, while niche stateside, has long been popular among Chinese influencers, or key opinion leaders (KOLs); the country’s shopping livestreams helped generate $63 billion in 2019 alone.

While the mass adoption rate remains to be seen, there is reason to be bullish on the trend, said Harvard Business School senior lecturer Jeffrey Rayport. “It’s hard for me to believe that a phenomenon would get so big in one part of the world but not translate to another,” Rayport said of live selling’s U.S. prospects.

This moment lends itself to live shopping mainly due to the meteoritic growth of e-commerce. According to Forrester data, online retail sales will grow by approximately 18.5% in 2020, the fastest increase since 2008. To chase this growth and potential revenue, more brands are investing in digital. Furthermore, consumers are spending more time at home and on their phone, resulting in more purchases.

According to research from marketing technology and consumer engagement provider Valassis shows, this increase in social media use is also impacting first-time purchases; Since the beginning of the pandemic in March, the report said, “21% of consumers have made an influencer-motivated purchase for the first time ever.”

The race to monetize live-streaming

From a retailers’ standpoint, IGTV and Reels have proven to be powerful marketing tools throughout the pandemic. Converting followers to paying shoppers is the next logical step, said Brandon Kruse, founder of live e-commerce solutions provider CommentSold. Consumption of live streaming content in the U.S. doubled since March, he said, which he described as a testament to social users continuously engaging with brands.

The pandemic is almost certainly a driver behind live streaming’s recent spike. One of the top complaints about buying online — one that retailers haven’t been able to translate well from brick and mortar — is the lonely experience it presents, Rayport explained.

Ad position: web_incontent_pos1

“The fact that Facebook wants to invest in it is telling,” he said. In his eyes, shoppable live video content stands to become what QVC and HSN did decades ago. “Those networks relied on their hosts to be authentic ‘storytellers’ with a connection to the audience, rather than salespeople,” Rayport said.

This isn’t the first time a tech giant tried to push online video commerce to U.S. customers. Live selling was tackled Amazon in the past, for example, but this attempt at disrupting QVC’s model fell flat. “Style Code Live,” a shoppable talk show format Amazon introduced in 2016, was abruptly canceled in mid-2017, with the company declining to comment on the reasons why.

That attempt, however, was pre-coronavirus, when Western audiences were yet to go all-in on e-commerce, said Daniel Mayer, co-founder and CEO of BeLive, a live streaming platform that works with SMBs.

There’s still a long road ahead to get Americans on board. Educating the market will take you ages and millions of dollars, Mayer explained. “These conditions are the best we’ll get,” he said of the opportunity to capitalize on the hungry, at-home audiences. For platforms like Facebook and TikTok, now is the time to try and get more brands to adopt the program, , said Mayer, especially as the online shopping boom continues.

Finding the right brands

According to Rayport, legacy brands with a lot on the line right now aren’t the right fit for live selling’s “magic recipe.” Big retailers will likely need to invest a great deal to make such an experimental program work.

Ad position: web_incontent_pos2

Most major retailers will need to invest in hiring on-camera talent on par with China’s KOLs (or the likes of the Kardashians) to see substantial returns. After all, it takes finesse and product knowledge to convince consumers that sponsored posts can’t fake, Kruse said.

With that, smaller businesses are more likely to be early adopters. When it comes to selling products on live video, big box brands may have the technology and resources, but they lack the nimble strategies that startups and SMBs often employee, said Kruse. For example, typically a corporate retailers’ social strategy requires many organizational approvals in order to get one decision okayed. Not to mention, the larger the retailer, the more room for error there is at the customer service and checkout stage, noted Kruse. For startups, he reasoned, there’s less noise. “SMBs’ advantage includes placing the ‘right face’ in front of the camera, as well as having the right SKUs,” he said.

“There is an art to finding the right host-sellers for the lives,” said Sheri Hensley, owner of Mississippi-based Pink Coconut boutique, which goes live three times a day on Instagram Live. She said the brand has seen a 20% increase in monthly sales since it began doing live sales. The Pink Coconut staff is set to do its first ever “24-hour live sale” on Black Friday and Cyber Monday.

As Hensley said of live selling’s potential: “the people are on there, so we should be there to entertain them.” In her estimation, with more consumers staying at home, entertainment-based shopping can become a quarantine digression. “We often hear we’re better than reality TV shows,” she said.