NFTs have become a big buzzword — both for crypto-enthusiasts and for brand marketers. And some companies have begun testing the blockchain waters. But, what’s an actual trend and what is just hype?

In this guide, Modern Retail deciphers what all of the jargon means, and gives some insight into how brands are using digital goods like NFTs. Read on to get a better sense of ways marketers are actually using the blockchain, as well as how these new technologies may become useful for retail brands.

Early in 2021, artist Beeble sold a piece of digital artwork at Christies for a record $69 million. For many, it served as the signal that NFTs had moved beyond internet edgelords and crypto geeks into a more mainstream audience. In the subsequent months, brands began dipping their own toes into the NFT waters. Some think of NFTs as a passing fad for people with expendable income to flaunt their wealth. Others think NFTs are a backbone to the future of the internet: an online “metaverse” of AR- and VR- augmented interactions. In any case, brands are increasingly testing out NFTs to drive media buzz, build out new revenue streams and connect to their brand community online.

Still – for those of us who aren’t on the ground buying, selling or creating NFTs – the concept can be confusing. Expensive digital art with no IRL component? How is that different from downloading a JPEG off the internet and claiming ownership? Let’s break it down.

An NFT, or non-fungible token, is a unique digital item generally stored on the Ethereum blockchain (while NFTs can be sold through other blockchains like Wax or Solsea, these are far less common). That includes a lot of tech jargon, so let’s break it down even further: Non-fungible refers to the fact that each item or token is unique, coded with identifiers and metadata to distinguish it from other tokens. While an NFT can really be any digital item — from a screenshot to a tweet to a gif — many of the biggest ticket NFT sales have been in digital art and collectibles. Ethereum is one of many crypto-currencies and its blockchain serves as a sort of digital ledger, recording and facilitating digital transactions of both NFTs and ETH cryptocurrency.

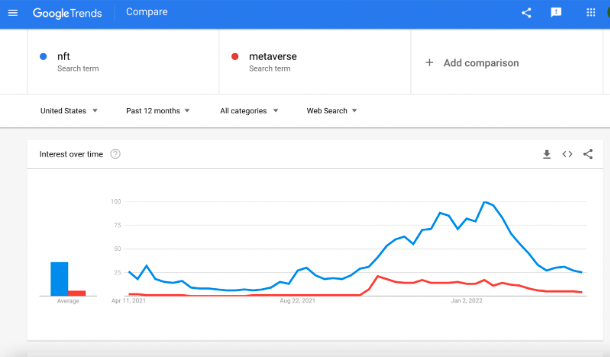

A 2014 artwork called Quantum – which featured a simple pixelated blue and green GIF – is largely considered the first NFT, but broader interest in the space skyrocketed in 2021. Indexed U.S. Google Search volume for the term from November 2014 compared to November 2021 is up 9,900%, for example, according to GoogleTrends. Reddit’s r/CryptoCurrency subreddit grew from 1.1 million members in December 2020 to 4.1 million members in December 2021.

Ad position: web_incontent_pos1

The number of use cases for NFTs has also expanded significantly over the course of the past two years. One – which has helped NFTs skyrocket to Twitter fame, or at least infamy – is a sort of digital, avatar-based membership.

Cryptopunks and Bored Ape Yacht Club (BAYC) arguably popularized NFTs as a sort of social club. Both used NFT avatars – a limited set of personalized images all in the same art style – combined with social club benefits to drum up buzz. In some ways, it can feel like the next iteration of Club Penguin, albeit on a much bigger scale and typically with more well-known names attached. This, February a single Cryptopunk avatar sold for $24 million. In January, meanwhile, Serena Williams joined the BAYC community for around $330,000.

Another use case is simply making money. Like it or not, NFTs are often high-priced, appreciating assets. Creators make money making NFTs, buyers make money reselling NFTs and NFT platforms make money hosting these sales. Brands can build revenue through any part of this process – building out NFT versions of IRL products or investing in NFT platforms to facilitate sales. Consumers, meanwhile, can purchase NFTs from brands for the chance at reselling them for more later.

However, NFTs — like cryptocurrencies — have faced a variety of controversies. The process to create or “mine” them is environmentally unfriendly. The crypto world — like Big Tech before it — has been called out for sexism and racism. And some finance experts worry the space is a house of cards, a bubble bound to burst.

Regardless, brands are increasingly recognizing the potential revenue in NFTs and Web3 and, accordingly, are boosting their investments in the space.

Ad position: web_incontent_pos2

Brands have recently embraced NFTs, ramping up their investments in the space over the past two years and expanding what they use NFTs for. However, the blockchain has a slightly longer history dating back to 2008. Here’s an abridged timeline:

2008: Satoshi Nakamoto introduces the first blockchain technology, Bitcoin, via a white paper.

2010: The first Bitcoin transaction takes place.

2014: Retailers and platforms like Overstock, Paypal and Microsoft start accepting Bitcoin checkout online.

2015: Vitalik Buterin launches Ether, a blockchain platform (that uses the Ethereum cryptocurrency) — on which many of today’s NFTs are stored.

2015: Robert Dermody, Adam Krellenstein and Even Wagner launch Counterparty, a peer-to-peer crypto trading platform on the Bitcoin blockchain.

2016: Users start trading memes and trading card NFTs on Counterparty.

2017: The now-largest NFT marketplace, OpenSea, launches.

2018: The first digital NFT festival, Rare Art Festival, launches.

2019: Flexa and Gemini partner together for a tech advancement that allows retailers to easily accept Crypto transactions in-store; retailers like Whole Foods adopt the technology in-store

2020: Decentraland hosts first NFT metaverse fashion show of community-created wearables

2021: Christies and Sothebys host their first NFT auctions while brands like Asics, Coke, Taco Bell, Mattel, Pizza Hut and Gucci all launch their first NFTs

- Ethereum blockchain: A cryptocurrency platform where the majority of NFTs are stored

- Open Sea / Rarible / Nifty Gateway: Three marketplaces where consumers can buy and sell NFTS, and where many brands have held their own NFT auctions

- GM/GN: Good morning, good night or one of the many bits of Twitter lingo used by NFT affectionados to talk about the space and greet each other

- IRL: In Real Life or anything non-virtual

- Metaverse: A 2D or 3D virtual reality environment where a user can interact with others virtually

- Web3: An idea of a decentralized, peer-to-peer internet run off of crypto transactions and spaces

- $69 Million: Highest selling single NFT, a Beeple painting at Christie’s

- $2.5 Billion: Estimated total NFT sales in the first half of 2021

- $10.7 Billion: Estimated total NFT in Q3 2021

- $40.9 Billion: Estimated total NFT sales in 2021

- 18-22: The age group most likely to have purchased an NFT according to Security.com

- 2%: The percentage of Americans who’ve bought or sold NFTs according to Security.com

In 2021, many mainstream brands began embracing NFTs to building new revenue stream and build their communities online.

The market is relatively new – according to Finder, 70% of Americans don’t even know what NFTs are. Moreover, 77% of NFT sales are from male artists and millenials are the most likely generation to invest in the space.

Still, the NFT market grew past $40 billion last year, according to blockchain analytics firm Chainanalysis Inc. The number of crypto wallets, meanwhile, grew to $28.6 million, according to DappRadar. In turn, brands are sensing the space may be ripe for investment.

This October, for example, media and lifestyle company Playboy launched Rabbitars: 11,953 NFT rabbit avatars and a virtual world to support interactions between owners. For a company struggling to revive the glamor of the social Playboy Clubs of the ‘80s, the virtual world of NFTs provided a new venue for modern community building.

Playboy has long focused on building exclusive spaces and membership touchpoints — from Hugh Hefner’s infamous Playboy Mansion to franchised resorts and nightclubs dubbed Playboy Clubs. However, in 1988, the media company closed its final Playboy Club and — after a failed reopening attempt in 2018 — there aren’t any IRL clubhouses for fans of the brand today.

Now, according to Jamal Dauda, Playboy’s vp of blockchain innovation, the company sees the blockchain as a way to reinvent itself and the experiences it once offered. “What does it look like to be a member, an ongoing participant in the world of Playboy?”

“When we decided to go down a road of membership, that inherently set us up for a longer term relationship,” said Dauda. “There’s plenty of places in our ecosystem of… one-off conversion points. What we were trying to re-establish and find were [those] who wanted to help us build the future of the brand.”

With the purchase of a Rabbitar NFT, users have access to Playboy’s metaverse – where NFT club members can meet and hangout online – as well as exclusive IRL events and products. Integrating the brand’s investment in blockchain across a wide range of features and products was important to keeping the brand in a “Web3” mindset, explained Dauda.

Crypto enthusiasts predict that Web3 is the future of the internet, moving interactions, commerce and content into a new peer-to-peer model. Under this conception, yesterday’s internet is Web2, where big tech intermediaries control the web.

“A lot of brands are looking at these tools and they’re trying to solve Web2 problems,” said Dauda. “We wanted to build something that was wholly, as much as possible, organically Web3, and try to honor the ethos of what’s really special and disruptive about this.”

The value — and challenge — of Web3 according to Dauda is the real-time feedback loop with engaged consumers. They’ll tell you — and show you — what they want, but there’s “a lot of expectation to build a lot of things very quickly.” Going forward, Dauda hopes to engage this loyal fanbase with further digital and in-person events, offer Rabbitar users other collectible purchasing opportunities and build a “meta-mansion.”

Playboy isn’t the only company that’s been testing out NFT offerings. Other brands, for example, have used NFTs to build buzz via charity auctions or built NFT revenue streams.

Below, Modern Retail looked at three case studies highlighting some of the different types of NFTs brands have launched, and how they’ve utilized the money from these NFTs. We also dived into the types of categories that lend themselves to more scaled NFT investment from brands and retailers.

For many brands, the easiest way to dip a toe into NFTs is a one-time-only auction through pre-established marketplaces with proceeds donated to charity. Indeed, this has been the strategy of brands like Taco Bell, Charmin, Coca-Cola, Macy’s, Crockpot and more. With minimal investment, brands are granted media coverage and a chance to connect with a new, younger digital audience.

Taco Bell sold its NFTs — a series of taco gifs and images — on NFT marketplace Rarible for a dollar each, with proceeds going to its Live Más Scholarship within the Taco Bell Foundation.

“When we further looked into this emerging community we realized the value of digitizing a piece of the brand for our fans that could live forever in a way that we hadn’t done before,” said Taco Bell’s head of brand creative, Tracee Larocca, over email. “We wanted to ensure that our foray into this space was fan-focused and purposeful.”

Crockpot, meanwhile, used NFTs to promote the brand’s 50th anniversary via an auction on NFT marketplace OpenSea. The single token highlighted Crockpot’s visual changes throughout its years in an animated GIF. It was listed for an opening bid of $100 and sold for about $500.

“It started with this idea that we revolutionized cooking back in the 70s,” said Joelle Robertson, senior director of brand marketing at Crockpot’s parent company Newell Brands. “So when we were thinking about how we would engage consumers this year to celebrate our 50th anniversary, the team had this idea for an NFT.”

As Crockpot searches for a younger generation of slow cooking consumers, added Robertson, news of the NFT could help the brand connect to a new audience. More broadly, Crockpot has been tapping into other millennial and Gen-Z platforms like TikTok: #crockpotrecipes has 1.1 billion views on the platform. The brand’s expanded product assortments – like smaller versions for apartment residents – keep these customers in mind.

Moreover, the drop also helped Crockpot make money for its charitable partner, Feeding America. The charitable aspect of this strategy is key. Through donating proceeds, brands aren’t tying themselves to profitability or a new revenue model based on digital items, but instead simply testing the space.

“This wasn’t a profit project,” said Robertson. “We sell product: that’s how we make money. We don’t sell art to make money.”

Alternatively, brands can use NFTs as either a primary or secondary revenue source.

Summer-themed internet radio station Poolsuite had site traffic when it first launched in 2019, but struggled to find a path towards monetization. Last year, founder Marty Bell launched sister brand Vacation, a sunscreen and merch company appealing towards Poolsuite’s summer vibes. However, the brand had room to further cement relationships with wealthy fans of the brand like Reddit co-founder Alexis Ohanian and DJ Diplo – and increase sales.

In turn, Vacation and Poolsuite launched an NFT “Executive Membership Program” in September 2021 at Art Basel Miami. For about $800, fans of the brands could purchase one of 2,500 tokens that would give them early access to product drops and member events.

According to Jason Consulting Group (JCG), the program raised about $2.6 million for the brand, about as much as the brand had previously raised in total VC funding. Bell told JCG the funding would be used to “build things with all the new Web3 technology that’s emerging at the moment, with the intention to turn Poolsuite into the wildest tech company on the web.”

Digitally-native brands like Poolsuite aren’t the only ones using NFTs to boost revenue. More traditional brands are also beginning to embrace the space. Luxury fashion house Dolce and Gabbana made more than $6 million via a hybrid NFT and IRL launch of a new fashion collection dubbed Collezione Genesi in October. In the same month, Mattel, meanwhile, launched over 5,000 four-packs and ten-packs of Hot Wheels NFTs starting at $15 to expand its products from real-life to online – and drive further revenue.

While NFTs may currently drive only a small portion of revenue for some of these brands – Dolce and Gabbana makes over a billion in yearly revenue, according to Bloomberg – brands have continued to ramp up their investment in NFTs this year. Earlier this month, for example, Dolce and Gabbana started fashion week with a show on NFT and metaverse platform Decentraland.

While some brands like Poolsuite have used NFTs for one-time sales, there’s also money in NFT resale. Some NFTs have begun appreciating in value over time, and the brands, platforms and users who resell NFTs can ink further revenue on each secondary transaction.

Like any other collectible before it – a Van Gogh painting or Rolex watch or Yeezy sneaker – NFTs aren’t worth the amount of money they cost to make, but instead however much the market will buy them for. A brand with a loyal fanbase like Nike, for example, can drop a virtual NFT sneaker the way it might an physical sneaker, for a new stream of product revenue. A casual buyer can resell it and make money the way they might have done with their old Jordans or Dunks. And a third-party platform like StockX can facilitate the resale for a percentage of the listing price.

Like IRL collectibles, NFTs drive value from a mix of perceived scarcity and cultural cachet. Moreover, just like IRL collectibles, NFT are often sold via one-time drops then resold for even higher values.

Christie’s global head of corporate and digital marketing, Matt Rubinger, earlier talked to Modern Retail after the decades-old art house facilitated the sale of an NFT by American digital artist Beeple for a whopping $69 million.

“Us selling the Beeple work in February for $69 million dollars… that will forever be the sale,” said Rubinger. “It’s what everybody looks at as what has kicked off the market.”

NFTs, added Rubinger, allow the art house to “lean into artwork on a new medium” as well as dive into “the height of collectability.”

Indeed, in the back half of the year, Christies surpassed $100 million in NFT sales of CryptoPunk Avatars, digitized Andy Warhol art, luxury fashion collectibles from brands like Gucci, and more. This December, Christies partnered with Open.Sea for its first “on-chain” auction.

Following in Christie’s footsteps, a variety of brands, retailers and marketplaces focused on collectibles have launched digital offerings over the course of 2021.

In March, luxury watch brand Jacob and Company sold its first NFT, a shiny black and gold timepiece highlighted in a 3-D animation. In April, trading card retailer Topps released a Major League Baseball NFT trading card collection and has had subsequent drops since. Nike, meanwhile, is filing trademarks for “virtual goods,” listing new jobs for virtual footwear and virtual material designers, and recently acquired virtual sneaker platform RTFKT.

“As collectibles enjoy a breakout moment with NFTs and blockchain technology, we can’t think of a better way to honor the legendary players from years past,” said Evan Kaplan, managing director of MLB Players, Inc in a press release about the Topps partnership.

But as NFT search interest wanes and controversies abound, the future of brands and NFTs is uncertain.

On the one hand, many brands and retailers are continuing to invest in NFTs this year.

Italian luxury fashion brand Hogan, apparel chain Gap and streaming network ESPN all created new NFTs within the past month alone. Moreover, Novel – a Shopify-integrated platform to help brands more quickly generate and sell NFTs – just raised a $6 million seed round.

On the other hand, broader interest in NFTs seems to be slowing. According to GoogleTrends, interest in the terms “NFT” and “metaverse” peaked in October and January, respectively. By April 3rd, however, “metaverse” searches were down 81% and “NFT” searchers were down 75%.

Moreover, not every brand investment in NFTs has been successful.

Direct-to-consumer underwear brand MeUndies, for example, faced significant pushback from brand fans about the perceived incompatibility of NFTs with a brand promising sustainability. In March, MeUndies walked back its NFT investment strategy publicly, apologized to fans, sold off its purchase, and donated proceeds to environmental causes.

Even Beeble – the artist whose $69 million NFT sale may have kicked off the NFT craze – told Fox News Sunday that NFT art was in “a bubble” just this March.

In turn, brands must tread carefully into NFTs in 2022 – balancing potential revenue with potential controversy.