Research Briefing: Uber’s decision to sunset Drizly highlights changing consumption patterns

In this edition of the weekly research briefing, we examine Drizly’s shutdown and the state of CPG distribution, as seen in data from Modern Retail+ Research.

Interested in sharing your perspectives on the future of retail, technology and marketing?

Apply to join the Modern Retail research panel.

Beverage brands are revisiting distribution options

Breaking News: Uber has announced that it will be sunsetting the Drizly app and consolidating its alcohol delivery under Uber Eats. Drizly was a major player in alcohol fulfillment during the pandemic, but its buzz began to die off when stay-at-home restrictions were lifted. Uber Eats focuses on food fulfillment by partnering with local retailers and restaurants, but also includes grocery and alcohol delivery. With the changes in fulfillment options, retailers and consumer packaged goods (CPG) brands may have to rethink how they get products to customers.

Questions: Where are startup CPG brands selling their products? What roles do retailers play in order fulfillment?

Answers From Research:

Ad position: web_incontent_pos1

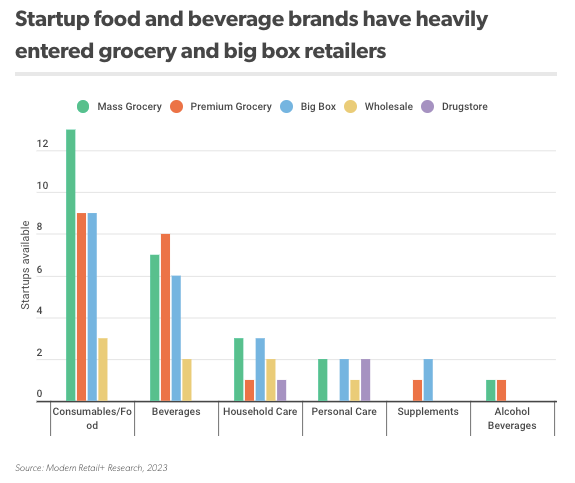

Consumers have likely noticed numerous food and beverage startup products lining the shelves at grocery stores, including premium grocers like Whole Foods and Erewhon, in recent years. According to analysis by Modern Retail+ Research, food and beverage startups have partnered with a large number of retailers, with food most popular in mass grocery and beverage most popular in premium grocery. The trend points to growing headaches in shipping and fulfillment processes and shifts in shopping trends post-pandemic.

Beverage brand Swoon co-founder Jennifer Ross previously told Modern Retail that her company decided to move away from DTC primarily because of the rising costs of fulfillment. “Selling a beverage and shipping it is very expensive because of the weight,” Ross said. “So it was hard to continue to make that [DTC] channel profitable while meeting consumer expectations and how quickly they want the product.”

Annie Atwell, director of marketing at hard kombucha maker JuneShine, said that post-pandemic most of JuneShine’s customers are buying its packs via same-day delivery services or at stores, instead of ordering from the brand’s website. “They’re buying it closer to the time of consumption and as part of their weekly grocery shop, so we’re investing in those channels appropriately,” she said.

Want to learn more: Modern Retail+ Research’s CPG startups analysis examines the direction that retail distribution is headed.

Ad position: web_incontent_pos2

READ MORE ABOUT CPG DISTRIBUTION

See research from all Digiday Media Brands: