Research Briefing: Amid Joann’s bankruptcy, here are the e-commerce strategies helping specialty retailers

In this edition of the weekly briefing, we examine Joann’s recent bankruptcy announcement and the state of e-commerce that led to its choice as seen in data from Modern Retail+ Research.

Interested in sharing your perspectives on the future of retail, technology and marketing?

Apply to join the Modern Retail research panel.

Joann’s e-commerce strategy did not stay current

Breaking News: Earlier this week, Joann filed for bankruptcy amidst economic turbulence and a pullback from consumers. Joann’s announcement comes a few years after it went public in 2021. The craft store saw massive revenue increases during the pandemic — during the first three quarters of 2020, it earned $1.921 billion, which was an increase of 24.3% compared to the same period the prior year. And the retailer noted an increase in e-commerce sales as well.

Much of its early success was due to the pandemic and the lockdown that caused people to stay indoors looking for DIY activities. After Joann went public, the company took on almost $1 billion in debt to expand operations and also to increase its e-commerce presence. However, despite its efforts, the company saw a decline afterwards and failed to keep up with other e-commerce retailers.

Questions: What e-commerce strategies are working for retailers? What are other specialty retailers doing digitally? What can other retailers learn from top players?

Ad position: web_incontent_pos1

Answers From Research:

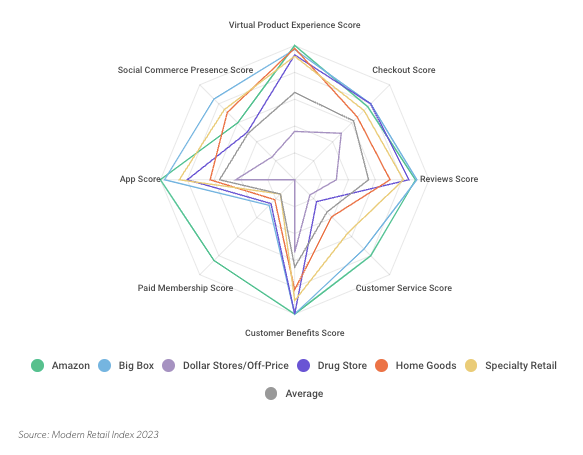

According to recent Modern Retail research, a few e-commerce strategies are helping certain specialty retailers stand out and be relevant.

The Modern Retail Index defines specialty stores by their focus on offering a specific product assortment that targets a precise interest or activity. The specialty retail category includes a range of retailers from a variety of industries, from beauty to pet care. Due to the different product categories among the retailers, comparisons are not often 1:1, such as comparing Barnes & Noble to Sephora.

Despite the different industries they represent, almost all the retailers in the cohort have adopted AR/VR technology, a common trend throughout the entire index.

Ad position: web_incontent_pos2

Sephora announced plans for its Smart Skin Scan, which will allow customers to scan their faces using their smartphone cameras. The images will then be processed by AI-powered tech and the tool will give recommendations for skincare products. Ulta announced a similar product through its partnership with Haut.AI. Haut.AI provides tools that allow users to scan images of their faces and skin in order to receive recommendations for skincare products.

Dick’s Sporting Goods applied AI to other e-commerce experiences rather than the direct digital product experiences that Ulta and Sephora aim to provide. The sports retailer partners with software developer Metrical to implement AI tools for cart abandonment and inventory management.

Another area of strength for the group is membership programs. While the cohort mostly offers non-paid memberships, the group places a large emphasis on creating loyalty programs with high incentives for the customer.

Sephora has one of the most famous loyalty programs in the index. Its “Beauty Insider” program features a tiered system based on annual customer spending amount, with benefits increasing as customers spend more in a year. Similarly, Ulta and Dick’s Sporting Goods also offer memberships based on a customer’s annual spend amount, with increasing benefits the higher the tier and the more the customer spends. Albeit a bit different to other specialty retailers, but still common in other industries, Barnes & Noble’s program has two tiers, free and paid.

Other cohorts looking to create loyalty programs can look to the specialty retail group for examples of non-paid memberships that aim to increase annual spending rather than draw revenue from membership fees.

Want to learn more: Modern Retail+ Research’s updated index on e-commerce strategies examines the current state of fulfillment and its main players.

READ MORE ABOUT E-COMMERCE STRATEGIES

See research from all Digiday Media Brands: