Why brands like Deciem are adopting month-long Black Friday campaigns to alleviate holiday fulfillment pressure

The holiday sale playbook is changing with more brands trying to account for potential fulfillment delays.

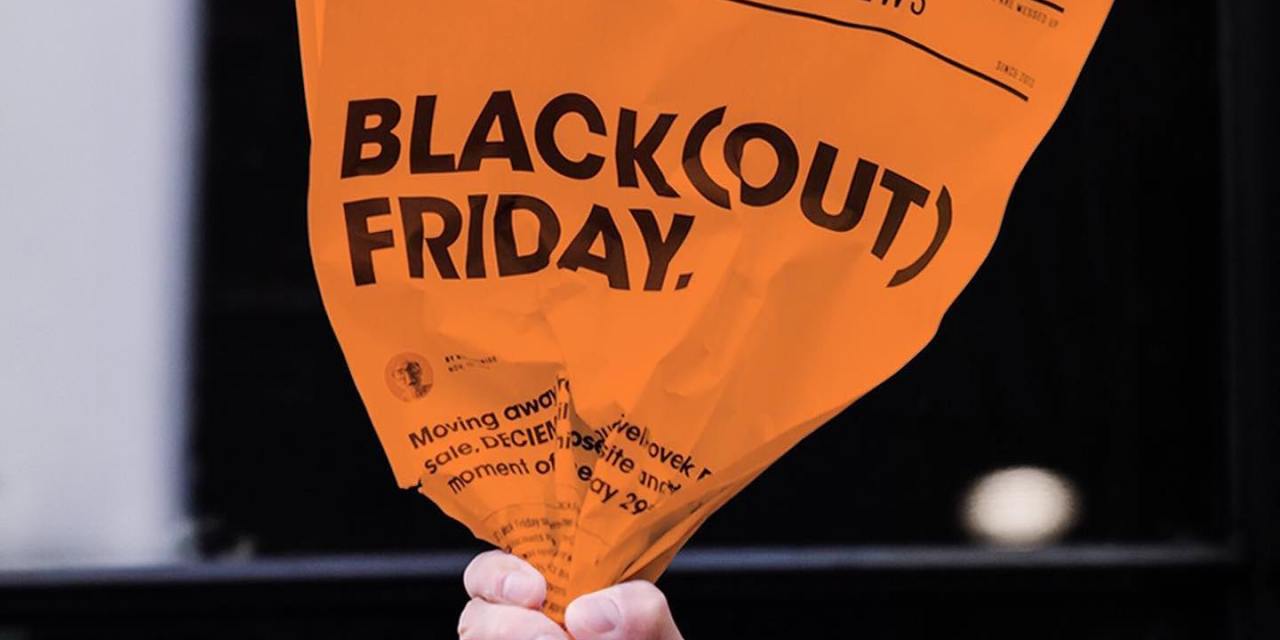

Thanks to Amazon’s seasonal kickoff last month of Prime Day, retailers anticipate a long and winding road of holiday shopping, forcing them to get creative with their marketing. One brand taking a month-long approach to sales is skincare brand Deciem, which brought back its conscious consumption-focused campaign for the second year in a row.

A growing concern for brands is that their e-commerce operations will be constrained due to fulfillment bottlenecks. As a result, they are increasingly pushing for longer campaigns, rather than shorter ones designed to simply to clear out inventory. Deciem’s program presents a potential playbook for how to go about it — it’s one that focuses both on new customer acquisition and managing stock.

Dionne Lois Cullen, vp of brand at Deciem told Modern Retail that this year’s campaign, which consists of a 23% discount on all products through the month, will feature daily educational content, hence the campaign’s name Knowvember. “By doing this we hope that we can encourage people to buy less, but better,” she said. The focus, she said, is to have a month-long campaign rather than a rush on a specific date. With last year’s results in mind, she hopes the program will result in longer customer journeys, more consistent conversion rate along with fewer anticipated returns.

The burden of shipping products in a timely way is something retailers are wrestling with, said Kevin Swanwick, vp of store solutions at Manhattan Associates. Several hiccups, like anticipated shipping carrier delays and stock shortage, are making handling large volume during busy periods even costlier this year. According to Salesforce’s seasonal forecast, up to 700 million packages face potential shipping delays, with orders exceeding shipping capacity by 5%.

According to Lois Cullen, last year’s discounts ended up boosting sales across several of the umbrella company’s beauty brands. Skincare brand NIOD, for example, saw a 400% sales lift. The event also resulted in new customer acquisition, with 51% of customers in November 2019 being brand new to the brand. “Shares of our Instagram post announcing the campaign were 1662% higher than our average,” she said.

Last year’s campaign also proved that streamlined discounting helps lure back existing customers. According to Lois Cullen, of the 49% of existing customers purchasing during November 2019, “25% had not repurchased in over a year.”

Ad position: web_incontent_pos1

Other retailers are taking similarly long-winded holiday sales approached. This week, Kohl’s kicked off a month-long countdown of its annual Black Friday sale, leading up to the Nov. 27 event. Some of the month-long deals include 15% off on both in store and online purchases. Similarly, Target has also unveiled plans to drop daily deals online and via its app to help minimize in-store crowds.

A key driver behind brands pushing holiday sales earlier has been the unknowns related to shipping and shipping cutoff dates, said Jake Cohen, head of product marketing at Klaviyo. He said that Deciem’s 23% off is also part of a site-wide discount trend consumers should expect to see from other companies. In short, retailers are “going with simplicity,” he said, in an effort to win over online shoppers.

The timing is especially important, as most brands and retailers expect digital holiday sales to accelerate at an unprecedented clip. According to NetElixir Retail Intelligence’s projections, overall online sales are due to register a 45% year-over-year increase in November, with a 20% spike in December. While most brands often prefer opt for sales during shorter time periods to allow for better control over margins, Cohen said, “they also know the e-commerce competition this year will be fierce.”