‘Still an area that needs to be proven’: Amazon is slowly incorporating live video into big shopping days

In February, Amazon launched Amazon Live, a page for its own QVC-like shopping videos that are livestreamed and produced by Amazon, as well as a new app that would allow brands to create their own live shopping videos. In the past several years, live shopping videos have especially taken off in China and become a critical component of brands’ strategies during the country’s largest shopping day, Singles Day. Although Amazon is encouraging more brands to test out Amazon Live, it has yet to become a critical driver of sales during large shopping holidays like Cyber Monday.

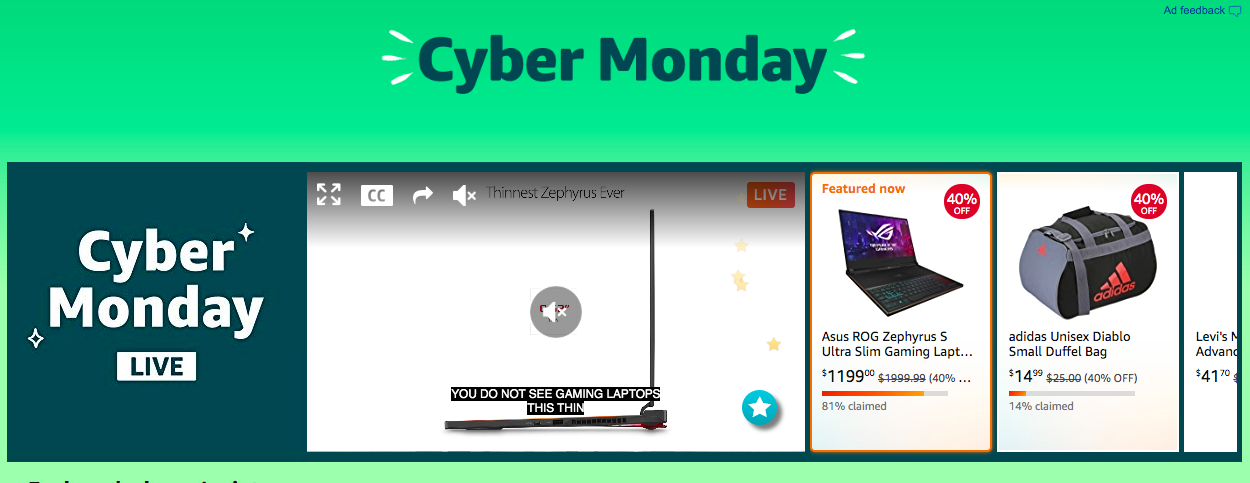

During Black Friday and Cyber Monday, Amazon included a livestream on the top of its deals page to demo products and highlight “lightning deals” — deals on products that only last for a few hours, or until the product sells out. The livestream is also displayed on Amazon’s home page, albeit below sections that highlight deals from “top brands” or deals on Amazon’s own electronic devices. Some of the brands highlighted in Amazon’s Cyber Monday livestream include Adidas, Champion, and Levi’s, as well as Amazon electronics.

According to Amazon, this is the third year that the company has used livestreams on Black Friday and Cyber Monday to highlight deals, and that while some video is pre-recorded, the majority of it is livestreamed. The company declined to share data about how many people watch the livestreams during big shopping days like Black Friday and Cyber Monday.

Analysts and agencies that work with Amazon think that Amazon Live could be a promising way to help customers cut through the number of deals during big shopping holidays like Prime Day and Cyber Monday. But they said Amazon still needs to do more to convince brands that it will drive sales, and is an area worthy of their investment alongside standard display and search advertisements.

“Amazon is trying to pitch a lot of things to a lot of folks,” said Mark Power, founder and CEO of marketplace agency Podean. “Amazon Live is still an area that needs to be proven.”

There’s two components to Amazon’s push into livestreaming — the first is Amazon Live, which is the name for videos that are produced by Amazon itself. Amazon does sell sponsorships for Amazon Live segments, though it doesn’t disclose exactly how much a brand might pay to sponsor a segment. There’s also the Amazon Live Creator App, which allows brands to create their own livestreams for free.

In China, brands use livestreams on platforms like Tmall and Taobao to give viewers access to exclusive deals on products, as well as answer questions about products in real-time. It’s another way for e-commerce giants like Alibaba and Amazon to convince brands to spend more on a new type of content that they purport will help customers discover new products, and subsequently convince them to buy more.

Kiri Masters, CEO of the Amazon consultancy Bobsled Marketing said she saw an uptick in emails from Amazon encouraging sellers to test out their first live streams ahead of Black Friday and Cyber Monday, by emphasizing that live videos are a helpful tool for product discovery.

Ad position: web_incontent_pos1

Amazon is not yet sharing just how much sales Amazon Live is generating for brands. But according to a pitch deck obtained by Ad Age last week, Amazon claimed that one beauty brand featured on Amazon Live “saw a 103% sales lift during the hours they were featured on Amazon Live compared to their average unit sales per hour over Prime Day. The pitch deck also claimed that a handful of other unnamed brands saw anywhere from a 58% to 110% sales lift during the hours their products were featured on Amazon Live compared to the average unit sales per hour they drove on Prime Day.

Juozas Kaziukėnas, CEO of research firm Marketplace Pulse, said that Amazon’s livestream has few bells and whistles to encourage viewers to watch the livestream for more than a few seconds. The livestream mostly features Amazon’s own hosts demoing products, and does not feature influencers from other popular platforms like YouTube or Instagram, or celebrities.

There also doesn’t appear to be any exclusive deals that viewers can get access to by watching the livestream. Alibaba, meanwhile, has encouraged more brands to use livestreaming in the lead up to Singles Day as a way to drive pre-sales, by giving their viewers early access to deals through the livestream.

Despite the slow start, it appears that Amazon Live will continue to be a part of Amazon’s sales strategy for upcoming holidays. In the pitch deck obtained by Ad Age, Amazon is looking to sell sponsorships for Amazon Live videos through the first quarter of 2020, timed to events like Valentine’s Day and New York Fashion Week.

Kaziukėnas thinks that Amazon Live could gain more traction among shoppers if Amazon surfaced the video in more places, and tried to do a better job of grouping deals, like by category, on Amazon Live.

Ad position: web_incontent_pos2

“Amazon has tens of thousands of deals running at any given point at time, and it can be heard to find them,” Kaziukėnas said. “I think it would be much more impactful if Amazon’s livestream was available on YouTube, or on some TV channels, or on Amazon Prime video channels.”